At Doulah & Doulah tax representation is an integral component of transactional advices to clients especially multinational corporations with foreign investments. Organizations need to maximize tax benefits in corporate and financial restructurings and navigate complex labor, employment and pensions regulations worldwide.

Clients turn to Doulah & Doulah for innovative and professional advice often spanning multiple jurisdictions comprising bilateral taxation issues. In all the key finance and business centers the firm has extremely strong domestic tax capability. This underpins the practice's ability to provide clients with relevant, specific and pragmatic advice on a truly international basis.

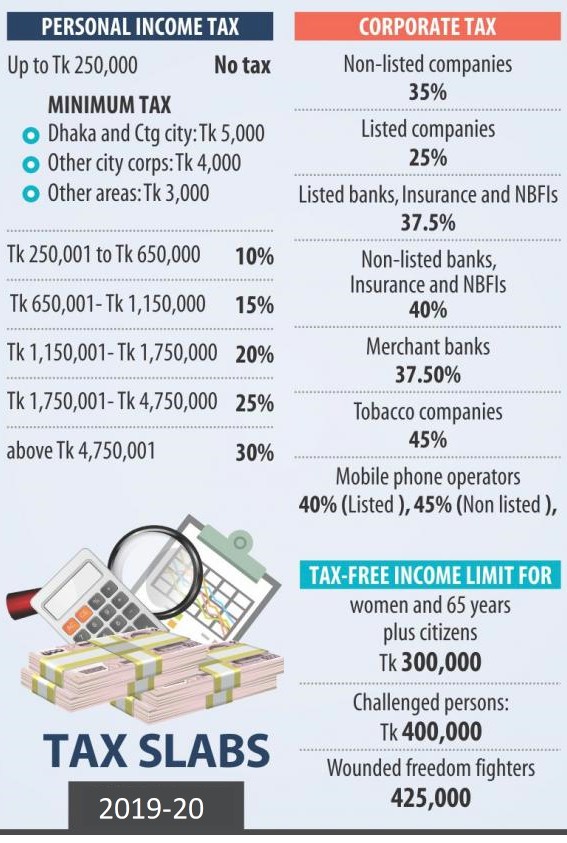

Regular tax practices at the firm includes advising on income tax, VAT and customs related issues arising from the domestic and international trade, compliance requirements for individuals and domestic and international entities carrying on business in Bangladesh, including in the not for profit sector, corporate re-organization and other related corporate work.

The firm advises on international and domestic tax, covering a wide range of financing, corporate and commercial issues together with advice on tax litigation, disputes and transfer pricing matters. In addition to advising on pure VAT technicalities the firm also provides commercial and practical advice on all forms of corporate, e-commerce, financial and real estate transactions.

The Firm also possesses extensive experience in judicial review of administrative decisions concerning assessment and payment of income tax, VAT and customs duly comprising the three-revenue streams for the National Board of Revenue.